When writing a request letter for a solvency certificate for a savings account, it's essential to maintain a respectful tone and clearly state your name, account details, and the purpose of the certificate. Request the bank's assistance in issuing the certificate by a specific date, mention your willingness to pay any charges, and provide your contact information for further communication.

Table of Contents:

- Sample Letter

- Live Editing Assistance

- How to Use Live Assistant

- Additional Template Options

- Download Options

- Share via Email

- Share via WhatsApp

- Copy to Clipboard

- Print Letter

- FAQs

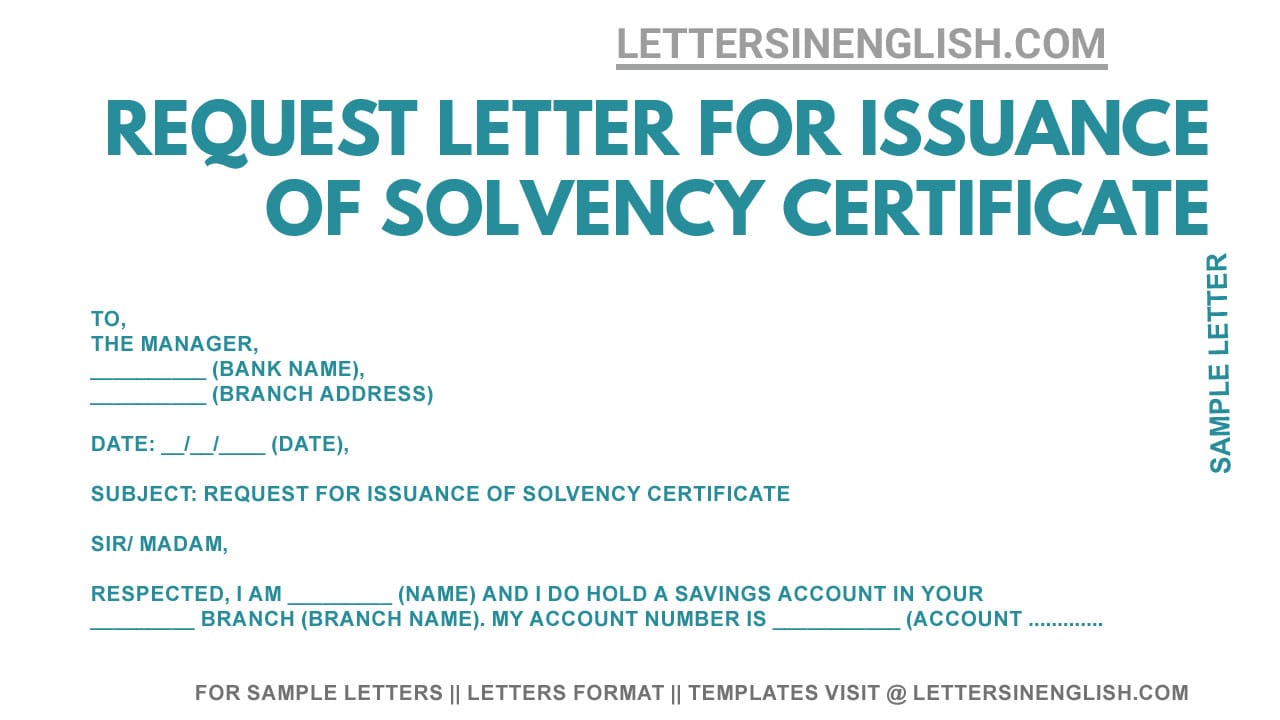

Sample Request Letter for issuance of solvency certificate

To,

The Manager,

__________ (Bank Name),

__________ (Branch Address)

Date: __/__/____ (Date),

Subject: Request for issuance of solvency certificate

Sir/ Madam,

Respected, I am _________ (Name) and I do hold a savings account in your _________ branch (branch name). My account number is ___________ (Account number).

Most humbly, I write this to request the issuance of a solvency certificate in my name for the above-mentioned bank account. I have been using this bank account _________ (Account number) for _______ (Duration – years/ months) and I am in need of the above-mentioned document as ______ (Mention reason). I am requiring the solvency certificate by __/__/____ (Date). I am ready to pay the required charges and do all the formalities in this regard.

I shall be highly obliged for your kind response. In case of any queries, you may contact me at __________ (Contact number).

Thanking you,

_________ (Signature)

_________ (Your name),

_________ (Contact number)

Live Editing Assistance

Live Preview

How to Use Live Assistant

The Live Assistant feature is represented by a real-time preview functionality. Here’s how to use it:

- Start Typing: Enter your letter content in the "Letter Input" textarea.

- Live Preview: As you type, the content of your letter will be displayed in the "Live Preview" section below the textarea.

Additional Template Options

The letter writing editor allows you to start with predefined templates for drafting your letters:

- Choose a Template: Click one of the template buttons.

- Auto-Fill Textarea: The chosen template’s content will automatically fill the textarea.

Download Options

Click the "Download Letter" button after composing your letter. This triggers a download of a file containing the content of your letter.

Share via Email

Click the "Share via Email" button after composing your letter. Your default email client will open with the subject "Sharing My Draft Letter".

Share via WhatsApp

Click the "Share via WhatsApp" button to send the letter as a message to a contact on WhatsApp.

Copy to Clipboard

Click the "Copy to Clipboard" button after composing your letter. You can paste the copied text anywhere you need.

Print Letter

Click the "Print Letter" button after composing your letter to print it directly from the browser.

FAQs

- Question: What is a solvency certificate for a savings account?

- Answer: A solvency certificate for a savings account is a document issued by a bank confirming the account holder's financial stability and the availability of funds in the account.

- Question: Why might someone need a solvency certificate for their savings account?

- Answer: A solvency certificate may be required for various purposes such as visa applications, loan applications, or legal proceedings where proof of financial stability is necessary.

- Question: Can a solvency certificate be issued urgently?

- Answer: Depending on the bank's policies, some may offer expedited services for issuing a solvency certificate urgently. It's advisable to inquire about the possibility of urgent issuance and any associated fees.

- Question: How long does it take to obtain a solvency certificate for a savings account?

- Answer: The processing time for obtaining a solvency certificate may vary depending on the bank's procedures and workload. It's recommended to inquire about the expected timeline when submitting the request.

- Question: Are there any charges associated with obtaining a solvency certificate for a savings account?

- Answer: Banks may charge a nominal fee for issuing a solvency certificate. It's advisable to check with the bank regarding any associated charges and payment procedures.

Incoming Search Terms:

- sample letter for issuance of solvency certificate of savings account

- savings account solvency certificate issuance request letter